X

Trade the way that suits you

Invest in Shares

Invest in over 35,000 domestic and international shares and ETFs from 15 global markets. Plus a wide range of domestic products including Options, mFunds, warrants and more.

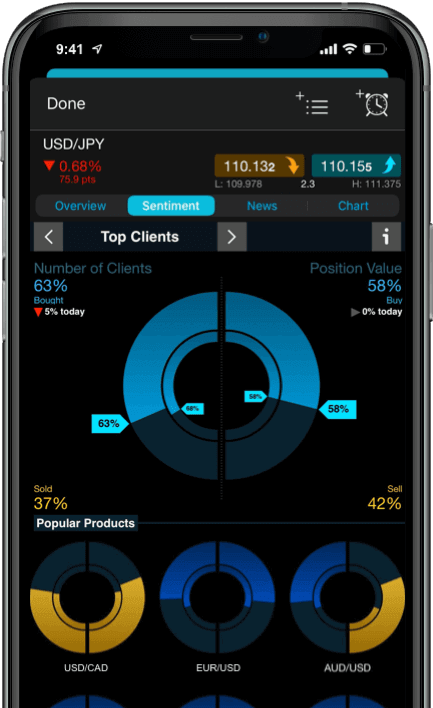

Open a Share Investing accountTrade CFDs

Trade contracts for difference (CFDs) on over 12,000+ products including FX Pairs, Indices, Commodities, Shares, Cryptocurrencies, and Treasuries.